Company depreciation calculator

Rental property depreciation calculator. After a year your cars value decreases to 81 of the initial value.

Depreciation Schedule Formula And Calculator

What is the best depreciation method for vehicles.

. Every business needs assets to generate revenue and most assets require business owners to post depreciation. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. However different cars depreciate at different rates with SUVs and trucks generally.

Audience Fixed Asset Management solution for companies About Depreciation Calculator Our software was designed and written with the. According to a 2019 study the average new car depreciates by nearly half of its value after five years. Depreciation Calculator is available for Windows.

See multiples and ratios. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred. See multiples and ratios. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

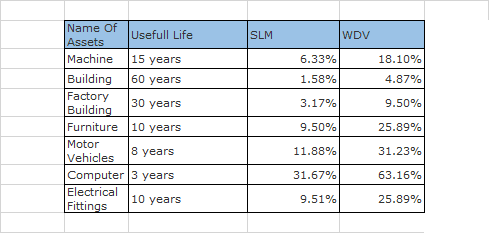

Depreciation Calculator as per Companies Act 2013. It takes the straight line declining balance or sum of the year digits method. The maiden ABCAUS Excel Companies Act 2013 Depreciation Calculator was first launched in March 2015.

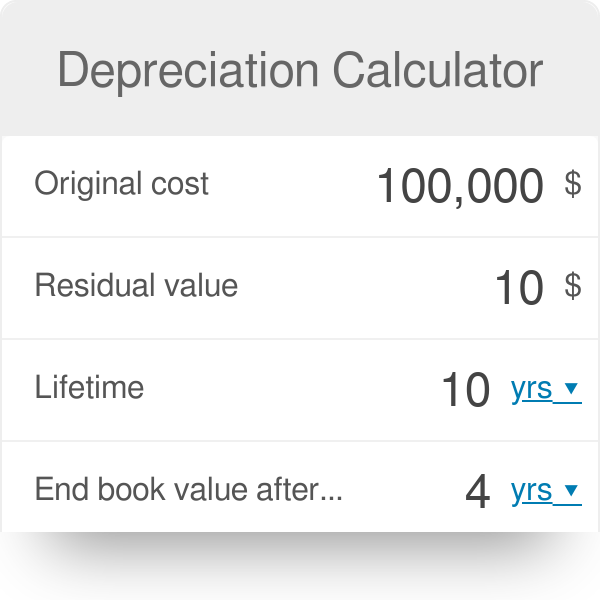

Depreciation is a way to reduce an asset value over a longer period of time. Use our free online depreciation calculator to work out the depreciation of the fixed assets for your business. Use this discussion to understand how to calculate depreciation and the.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. See the value of a company before and after a round of funding. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only.

See the value of a company before and after a round of funding. Ad See what you can research. Depreciation calculator companies act.

Business vehicle depreciation calculator. Vyapar depreciation calculator can help you create a depreciation schedule for any fixed asset. Enter the salvage value how much you expect youll be able to sell the asset for when youre done using it Adjust the life of asset slider to the number of years you expect the asset will last or.

The ABCAUS Depreciation calculator for FY 2021-22 has also been. Car Depreciation Calculator This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Depreciation Calculator The following calculator is for depreciation calculation in accounting.

The major features of this free utility includes. Before you use this tool. The calculator also estimates the first year and.

There are many variables which can affect an items life expectancy that should be. Calculation of Depreciation and WDV from Fin Year 2015-2016 to Fin Year 2021-22. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2.

Our car depreciation calculator uses the following values source. Ad See what you can research. Facility to calculate Depreciation based.

After two years your cars value. Depreciation limits on business vehicles. Since the performance of a vehicle is.

The tool includes updates to. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

1 Free Straight Line Depreciation Calculator Embroker

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Definition Formula

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation As Per Companies Act 2013 Depreciation Chart As Per Companies Act Youtube

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator For Companies Act 2013 Taxaj

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Schedule Formula And Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculator

Depreciation Calculation As Per Companies Act 2013

Depreciation Calculation